You will need to provide us with your credit reports from all three major bureaus: Equifax, TransUnion, and Experian. We recommend using SmartCredit.com or MyFreeScoreNow.com to access all three reports easily, as these platforms offer user-friendly features and valuable tools if you choose to maintain a membership. However, if you prefer a different provider, you’re welcome to use any service of your choice to obtain your reports

Secondly, we will conduct a thorough credit analysis of your report, identifying and highlighting any inaccurate information. We analyze the key factors negatively impacting your credit score and offer clear, actionable steps to help improve it. Finally, we guide you through a step-by-step process to rebuild and restore your credit. Our comprehensive approach is designed to repair your credit from start to finish, with the ultimate goal of helping consumers with poor credit regain financial stability through our restoration program.

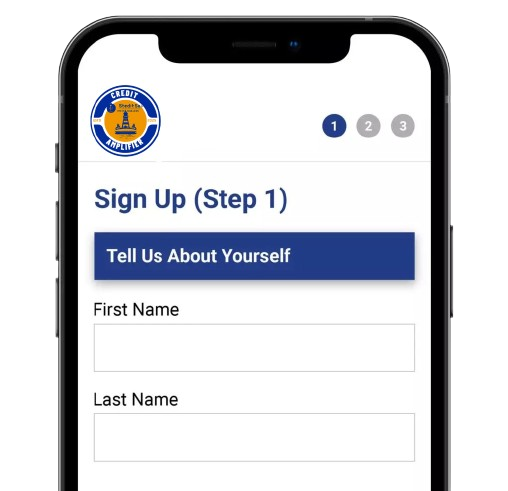

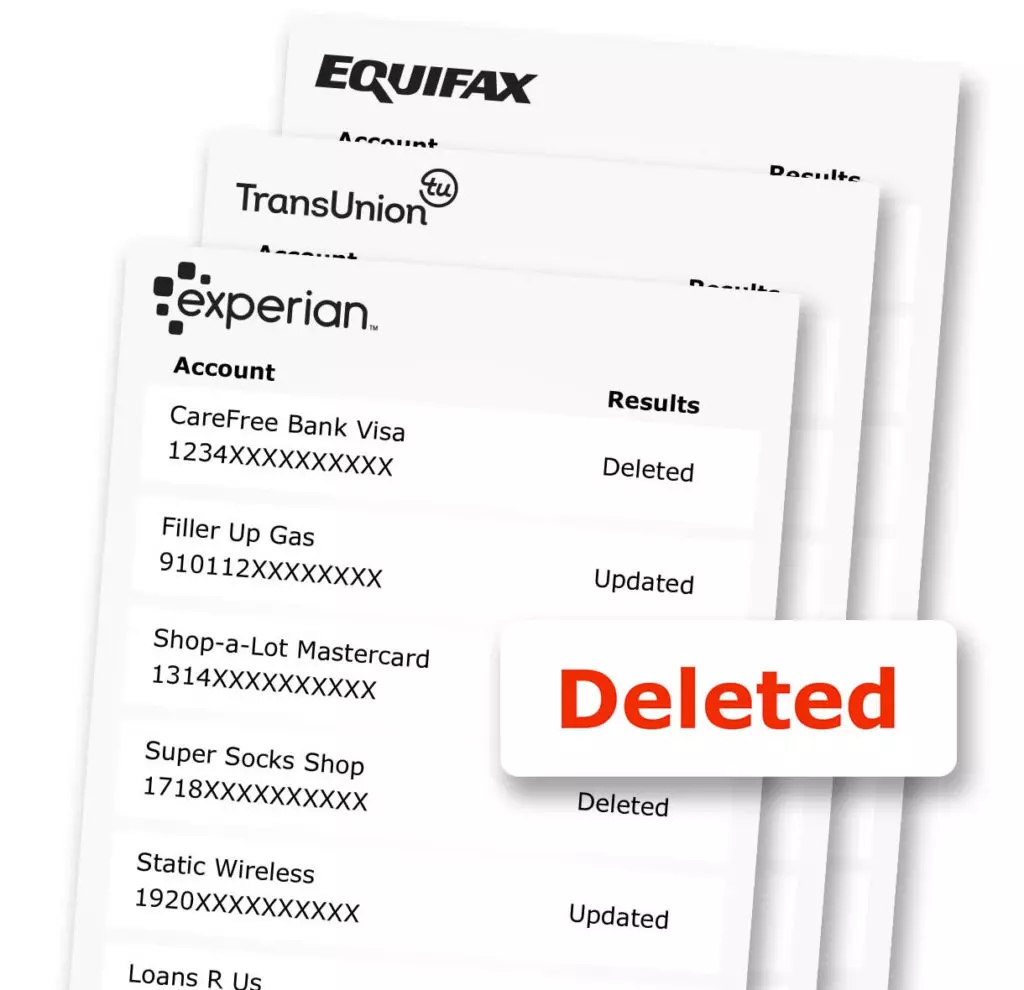

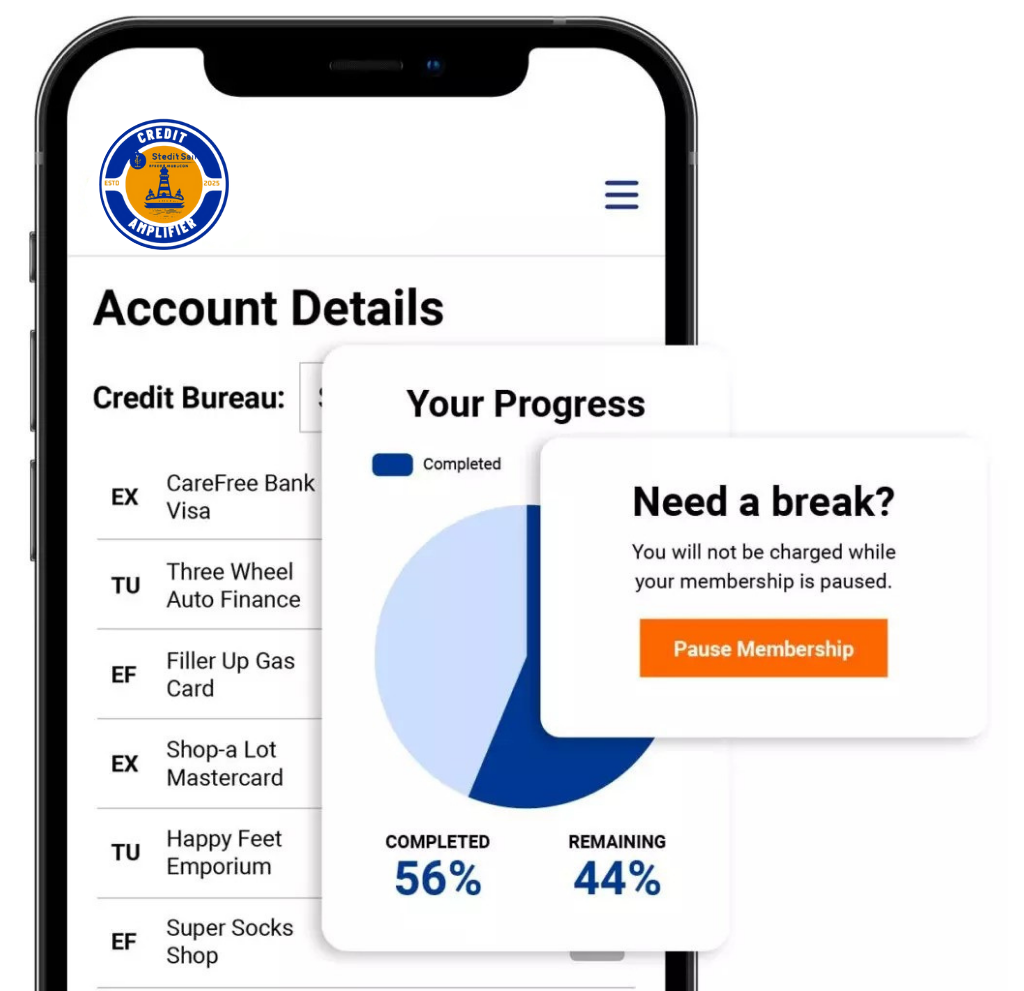

Third, we enter all inaccurate, misleading, or unverifiable information into our system and begin the process of disputing these items with the credit bureaus, creditors, and collectors. Once the dispute letters are prepared, we send them out and wait approximately 30 to 40 days for updates. Throughout the process, you can monitor your credit repair progress through our online portal. Our service is designed to handle your credit repair from beginning to end, with the goal of helping individuals with poor credit through our comprehensive restoration program.

Please Note: You can mail the dispute letters to the credit bureaus, creditors and collectors yourself. You must send the letters via certified mail. Be sure to open all of your mail and upload the replies from the credit bureaus to your Client Portal in order for us to continue working on your credit.

Alternatively, we use a service to mail dispute letters on your behalf and we will bill your account for the cost of each mailing. Please remember to upload response letters from the credit bureaus onto your Client Portal in order for us to continue working on your credit.

Once the updated credit reports are received, we carefully review them to identify any changes related to the inaccurate, misleading, or unverifiable information. If updates have been made, we revise your file accordingly and proceed to address the next item. If an item is verified without any changes, we follow up directly with the credit bureaus to seek clarification and work toward resolving why the inaccurate information remains. Our process is comprehensive, handling your credit repair from start to finish. Our mission is to assist individuals with poor credit through our dedicated repair and restoration program.

Remember this process takes time, and you will know what we are doing every step of the way.

Thank you for choosing Credit Amplifier to helping you improve your credit and your prospective financial future!

Credit Monitoring Service

We highly recommend signing up for a credit monitoring service. Having a credit monitoring account helps you:

Track Your Progress You can see real-time updates as negative items are removed and your credit improves.

Catch Errors Fast If something incorrect pops up on your report, you’ll know right away and can take action quickly.

Protect Yourself from Identity Theft Get alerts if someone tries to open a new account in your name.

See All 3 Credit Bureaus Some services show Experian, TransUnion, and Equifax all in one place, which most free tools don’t.

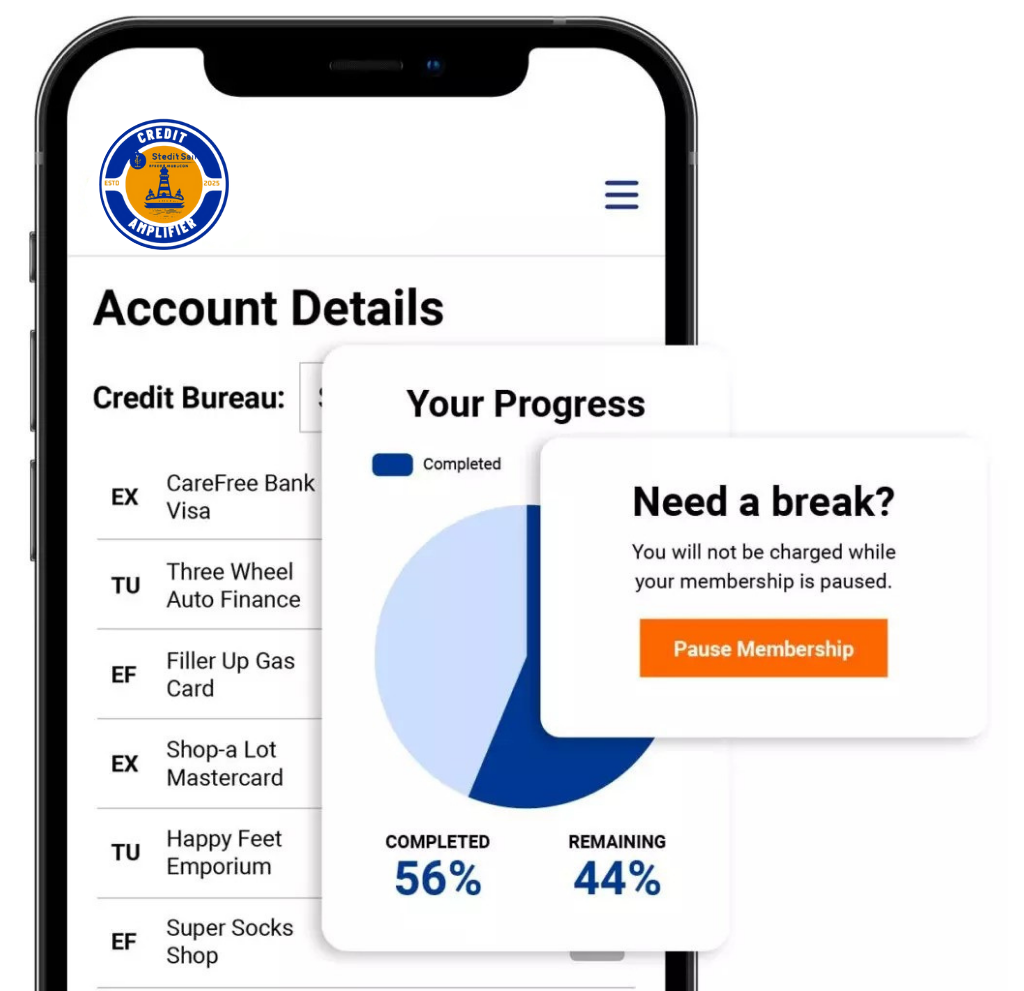

Work Faster With Your Credit Specialist We can’t move forward without updated reports, credit monitoring keeps everything flowing smoothly. We need your credit reports and scores to start the credit restoration process. Using a credit monitoring service allows us to log into your account every 30 days to check for 30 days to check for updates to your credit reports and scores.

If you choose not to sign-up for a credit monitoring service, you will need to personally obtain your credit reports from Experian, Equifax and TransUnion every 45-days for updated reports and upload them onto your Client Tracking Portal for us to continue working. Please note that this will significantly delay our progress on your credit repair.

Instructions to send certified mail

Sending certified mail through the United States Postal Service (USPS) is a reliable way to ensure your mail is delivered securely and that you receive proof of delivery. Please follow the step-by-step instructions:

📬 Certified Mail Checklist – USPS

Step 1: Prepare the Mailpiece

- Address envelope/package clearly and correctly

- Affix sufficient postage or prepare for payment at USPS

- Seal envelope securely

Step 2: Complete Certified Mail Form

- Fill out PS Form 3800 (Certified Mail Receipt)

- Affix barcode sticker to top edge of envelope/package

- Retain bottom portion of the form for tracking

Step 3: Add Optional Services (if needed)

- [Optional] Add Return Receipt (PS Form 3811) – physical or electronic

- [Optional] Add Restricted Delivery – for specific recipient only

Step 4: Submit at the Post Office

- Bring mail to USPS counter

- Ensure clerk stamps and returns receipt with postmark

- Pay for certified mail and any optional services

Step 5: Track and Confirm

- Retain receipt with tracking number

- Monitor delivery at www.USPS.com

- If applicable, wait for Return Receipt confirmation (signature)

Tip: File all receipts securely for recordkeeping.

A Clear Guarantee

Get started with confidence. Our service is backed by a Money Back Guarantee if your credit does not improve.

“This was the best decision ever. A great success!”

Google | Emma L.